We’re rated Excellent on

PAYMENT PROCESSING

Payment Processing Llandovery

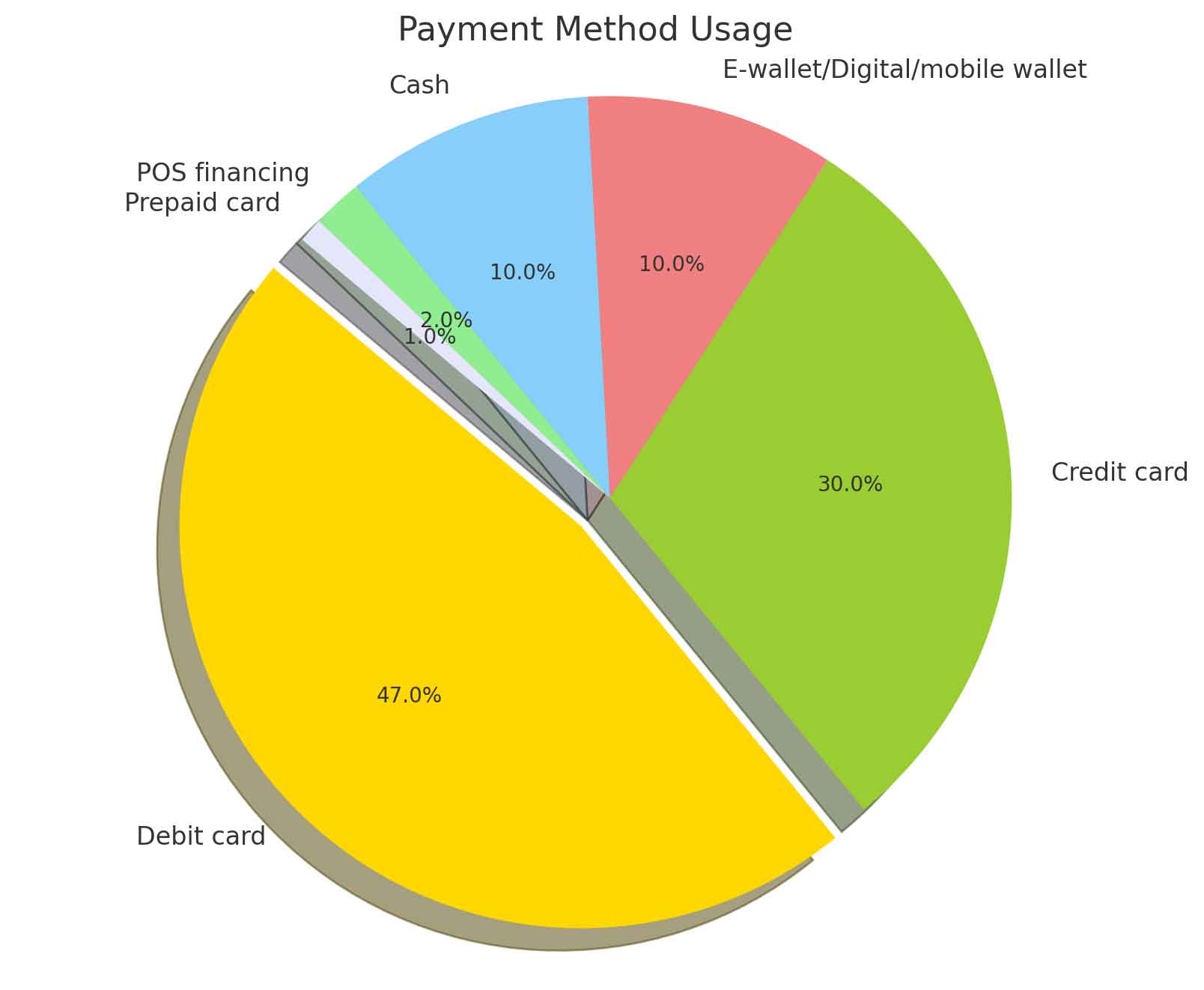

In an era where convenience and speed are paramount, the landscape of payment processing is rapidly evolving. As a business based in Llandovery, Carmarthenshire; embracing this shift can set you on a path to growth and customer satisfaction. The latest figures paint a clear picture: electronic payments are on the rise, with 47% of transactions now made via debit card and a further 30% through credit cards. Cash payments, once the cornerstone of commerce, are witnessing a decline, making up only 10% of consumer preferences. This is a trend supported by the significant growth in payment technology; the number of merchants accepting card payments soared to 1.38 million outlets in 2017, and the last five years have seen a 50% increase in point-of-sale terminals.

The transformation is driven by technological advancements that offer a plethora of choices in payment methods, bolstered by the ubiquity of smartphones and the convenience of online and mobile banking, as well as contactless payments. In 2019 alone, 34.9 billion payments were made by consumers, with a staggering 65% of UK adults holding a credit card. The adoption of contactless payments surged by 31% in 2018, reaching 7.4 billion transactions. With nearly 124 million contactless cards in circulation by the end of 2018, and a commitment from the card industry to make every payment terminal contactless-capable by January 2020, it’s evident that the future is digital.

Don’t let your business lag in the past; join the revolution and enable your customers to tap into the future of payments. Sign up for our payment processing facilities today and unlock the potential of every transaction.

EXCELLENT REVIEWS

What People Are Saying

100% recommended

Couldn’t have been better!

Brilliant 5 Star Company

Professional and Competitive

Start Payment Processing in Llandovery

Step through the portal to seamless transactions and cost-efficiency with our streamlined form, your connection to premier UK Payment Service Providers. Tailored for both newcomers to card payments and seasoned businesses seeking to trim down costs in Llandovery or througout Carmarthenshire, our service is your financial ally.

Partnering with more than 90% of the UK’s top providers, we are committed to securing the most advantageous deals for your enterprise. Bid farewell to the burden of steep transaction fees and pave the way for your business’s expansion.

Contactless Payments Llandovery

Unlock the full potential of Payment Processing with our cutting-edge contactless solutions. Our service equips your business to seamlessly handle payments via Chip & PIN, as well as through the latest in smartphone and smartwatch technology. Featuring sleek card readers, we guarantee a transaction experience that’s not only rapid but also secure and exceptionally smooth for your customers. With every tap of a card or smart device, your business reinforces its position at the vanguard of Payment Processing innovation. Transform your checkout journey with our contactless Payment Processing.

Smartphone Payment Apps Llandovery

Dive into the next wave of Payment Processing with our Smartphone Payment Apps—your tool for mastering mobile transactions. This advanced solution converts your smartphone into a dynamic Payment Processing terminal, empowering you to accept payments from customers no matter where your business takes you. Designed for ease and fortified with top-tier security, our apps facilitate fast and fortified transactions directly from your device. Experience the pinnacle of convenience and adaptability, ensuring you’re always equipped to cater to your customers’ Payment Processing demands.

Payment Gateways Llandovery

Payment Gateways serve as the cornerstone of secure and fluid online Payment Processing. They function as the essential link between your business’s online presence and the payment processing infrastructure, these gateways accommodate all principal credit and debit cards, offering your customers an expansive selection of payment methods. Equipped with powerful fraud prevention mechanisms and straightforward integration, Payment Gateways are a vital component for any enterprise aiming to prosper in the digital economy. Elevate your online Payment Processing strategy.

Cutting-Edge Payments Llandovery

Step into the realm of Advanced Payment Processing, where transactions transcend speed and enter the realm of the futuristic. Our technology equips businesses to receive payments from an array of smart devices, encompassing smartphones and smartwatches alike. Harmonizing with renowned platforms such as Apple Pay, Google Pay, and Samsung Pay, our Payment Processing solutions are tailored for a digitally discerning clientele. They epitomize ease and fortification, guaranteeing a seamless, contactless exchange with each interaction. Optimal for any business, these modern Payment Processing methods are the keystones of efficacy and consumer delight.

Take Payments Over The Phone Llandovery

Classic Phone Payment Processing retains its essential role in commerce, delivering a touch of personal interaction amidst the surge of digital transactions. This enduring method enables customers to complete payments with ease, through a phone call where they can securely relay their card information. It’s an established, reliable process, perfectly suited for customers who value a direct human element or may not be inclined towards technology. By blending security with simplicity, phone Payment Processing appeals to a wide range of consumers, maintaining your business’s approachability. It’s a timeless Payment Processing strategy that maintains its relevance and in today’s market.

Open Banking Payment Links Llandovery

ssRevolutionary Open Banking PayLinks are transforming Payment Processing with unprecedented efficiency. By harnessing the capabilities of open banking, these PayLinks bypass conventional card processing, facilitating direct and secure transactions. Businesses can swiftly dispatch PayLinks or QR codes to their customers, who can then settle payments promptly and securely. This innovation is not just a fast track to financial transactions; it also circumvents traditional card processing charges, optimizing the Payment Processing experience for merchants and consumers. Open Banking represents a leap forward in financial convenience and Payment Processing.

Never Miss a Payment

Ensure every Llandovery customer payment is captured by offering the most up-to-date payment options like Google Pay, Apple Pay, and Samsung Pay; embrace the convenience of e-payments via mobile phones and smartwatches.

Watch your sales grow as a result of embracing modern Payment Processing technologies.

Face to Face Payments

Mail or Telephone Payments

Online Payments

Card Readers for Payment Processing Llandovery

In the UK, credit card machines, card readers, and PDQ (Process Data Quickly) systems have become indispensable at points-of-sale, providing fast and secure payment methods. Modern credit card machines boast remarkable versatility, facilitating payments via contactless cards and NFC (Near Field Communication) enabled mobile phones, aligning with the convenience demands of today’s consumers.

Small enterprises often opt for compact card readers from providers like SumUp or iZettle, which, while user-friendly, may lead to higher transaction fees for businesses experiencing significant sales volume.

Wireless PDQ machines are increasingly popular for their adaptability and seamless connectivity, functioning effortlessly over phone networks – a feature that proves invaluable in less connected locales. The integration of these machines with EPOS (Electronic Point Of Sale) systems represents a growing trend, evolving into a cohesive, efficient Payment Processing solution. The varied contract options for PDQ machines, from short-term hires to long-term commitments that reduce fees, add to their appeal. Their flexibility and cost-effectiveness make them an ideal choice for businesses in pursuit of streamlined and economical Payment Processing strategies.

Card Machine Transaction Fees Llandovery

Transaction fees for card machines vary depending on the provider and contract type. Traditional merchant account providers calculate fees based on card and transaction types, offering tailored rates for different scenarios. In contrast, the newer casual contracts often feature “blended” rates, where all transactions are charged at a uniform rate. However, this uniformity may not extend to mobile payments like Apple Pay and Google Pay. Understanding these fee structures is crucial for businesses to manage their costs effectively and choose the most economical option for their transaction volumes and types.

Card Machine Monthly Fees Llandovery

Monthly fees for card machines are also subject to the terms set by your merchant account provider. Traditional contracts may include a monthly fee, which is often determined by the volume of transactions and the nature of your business. For small businesses opting for casual card machine contracts, there’s frequently no monthly fee for a basic level of transactions. However, larger or multi-site businesses typically incur a monthly fee, usually around £10, in addition to transaction fees. This fee structure is designed to accommodate different business sizes and transaction volumes, offering flexibility and scalability for growing enterprises.

Taking a Card Payments with Card Machines in Llandovery

- Make sure the card machine is powered on and ready to connect to the data network.

- Load or input the transaction details ready to process the sale.

- Allow the customer to place their card near the NFC sensor on the card machine if the payment is under £100. If the payment is over £100 the customer will be required to insert the card into the reader and follow on-screen instructions to input their PIN.

- The card machine will connect over the data network and attempt process the transaction.

- Either the transaction will complete or the customer may be required to input their PIN for added security (see step 3).

Get Card Machines Llandovery

Elevate your customer transactions to new heights with our sleek and dependable card machines, a vital component of Payment Processing. These devices are expertly crafted for businesses where customer engagement is paramount, guaranteeing a streamlined point-of-sale interaction. Establishing a merchant account with us opens the door to the newest advancements in card reader technology—fast, secure, and aesthetically suited to your business environment. Ideal for retail, hospitality, or any customer-centric sector, our card machines are designed to seamlessly integrate with your Payment Processing needs, ensuring each transaction is a blend of ease and professionalism.

Contactless Card Payments Llandovery

Take your business to the next level with the efficiency of Contactless Card Payments, a cornerstone of modern Payment Processing. These rapid, secure, and effortless payment methods perfectly align with the contemporary consumer’s demand for quick and straightforward transactions. Our state-of-the-art contactless technology guarantees that every payment is not just fast, but also adheres to the strictest security protocols. Especially suitable for bustling retail settings or any fast-paced service business, contactless payments minimize wait times and elevate customer satisfaction. Provide your patrons with the peak of payment convenience and innovative, customer-focused service.

All Payment Acceptance Llandovery

Keep your business at the forefront with card machines that embrace the latest Payment Processing trends. Our top-of-the-line devices are not limited to standard card payments; they’re also adept at processing transactions from smartphones and smartwatches. This adaptability meets the varied payment preferences of your customers, accommodating swipes, taps, or scans. Incorporating technologies such as Apple Pay, Google Pay, and other NFC (Near Field Communication) methods, your business becomes synonymous with convenience. Offering these diverse and flexible payment options cements your reputation as an innovative, customer-centric organization.

Merchant Accounts Llandovery

Selecting the right merchant account is crucial for payment processing, involving several key factors:

- The nature of your products or services

- The average size of your customer transactions

- Your preferred methods for accepting payments: in-person, over the phone, or online.

- Understanding these elements will guide you in choosing an account that aligns with your business needs.

Payment Processing for Small Businesses Llandovery

For small businesses eager to optimize their Payment Processing, our Merchant Account services are a game-changer. Specializing in expediting and facilitating applications, we make it easier and more efficient for small businesses to embark on their Payment Processing journey. Our expansive network, encompassing over 90% of the UK’s foremost merchant account providers, banks, and acquirers, enables us to present bespoke options that align precisely with your business needs.

Recognizing the distinctive requirements of each small business, we offer tailored support throughout the process. Our expertise proves invaluable in demystifying the complexities involved in establishing a merchant account, ensuring a streamlined and trouble-free setup. We take pride in aiding thousands of UK businesses in acquiring merchant accounts that boast competitive rates, stringent security, and dependable customer service.

By choosing to partner with us, small businesses benefit from our extensive industry insights and established connections with top financial entities. This not only hastens the setup phase but also guarantees a merchant account solution that is both economically viable and ideally matched to your business operations.

Corporate Payment Processing Services Llandovery

Our Corporate Payment Processing Services are specifically tailored for large corporations, chain stores, and hotel chains, providing a sophisticated and scalable approach to handle their unique demands. These services are designed to meet the challenges of high-volume, complex operations, offering custom solutions that are in sync with the nuances of expansive business models. Leveraging our broad network, which includes over 90% of the UK’s top merchant account providers, banks, and acquirers, we’re adept at securing terms that best suit the specific needs of corporate entities.

Our proficiency encompasses addressing the distinct challenges that large businesses face, such as integrating diverse payment systems across various locations, ensuring consistent compliance, and implementing strong security protocols to safeguard against fraud and data breaches. We recognize the need for both efficiency and adaptability in corporate payment processing and strive to provide solutions that embody these qualities.

Beyond traditional payment methods, our services extend to the latest digital and mobile payment technologies, positioning corporations to lead in the ever-changing payment landscape. With a history of supporting numerous esteemed clients, our team is well-equipped to offer exceptional support and advice, ensuring your corporate payment processing is efficient, secure, and aligned with your overarching business objectives.

We’re rated Excellent on

Payment Processing Llandovery

For UK consumers, payment processing typically appears straightforward – just a swift swipe or tap of a card. However, this seemingly instantaneous action sets off a complex series of events behind the scenes to finalize the transaction. Business owners often perceive payment processing as a convoluted and challenging concept.

Yet, it needn’t be so daunting. Payment processing comprises an array of systems and processes that, when elucidated clearly, become quite comprehensible. In this guide, we aim to demystify the steps involved in payment processing, clarifying how they relate to your business and your customers. Our goal is to equip you with the knowledge and confidence to seamlessly handle credit and debit card transactions in your UK business.

What is Payment Processing?

Understanding Payment Processing in the UK

Understanding Payment Gateways in the UK

Payment Processing: Understanding Payment Processors in the UK

Merchant Accounts in UK Payment Processing

Security Practices in UK Payment Processing

Getting Ready for Payment Processing

What is Payment Processing?

In the UK, payment processing refers to the sequence of steps that unfold when a business initiates a digital payment transaction. This encompasses everything from card processing and opening secure gateways, to liaising with banks and customer accounts.

With the latest statistics showing that 47% of transactions are made using debit cards, 30% via credit cards, 10% through e-wallets or digital/mobile wallets, another 10% in cash, 2% using POS financing, and 1% through prepaid cards, it’s evident that digital payment methods are increasingly preferred in the UK market.

Why is Payment Processing Gaining Popularity?

The advantages of payment processing are significant. Advanced technology enables these transactions to be executed swiftly and efficiently. Data is securely transferred from merchant terminals to consumer banks and vice versa within moments. These systems manage all the communication between issuing banks, credit card companies, and financial institutions, ensuring that the transaction process is seamless and transparent to the user.

Types of Payment Methods in the UK:

- Debit Cards (47%): Physical cards linked to a user’s bank account, allowing direct access to their funds for transactions.

- Credit Cards (30%): Cards issued by financial institutions that offer a line of credit to consumers for purchasing goods and services.

- E-wallets/Digital/Mobile Wallets (10%): These are applications on smartphones or other devices that store payment information digitally and facilitate electronic transactions.

- Cash (10%): Traditional physical currency used for direct transactions.

POS Financing (2%): Point-of-Sale financing options that allow consumers to purchase items through installment payments at the time of sale. - Prepaid Cards (1%): Cards pre-loaded with a set amount of money, used as an alternative to cash for transactions.

This diverse range of payment methods demonstrates the UK’s adaptive and varied approach to financial transactions, catering to different consumer preferences and technological advancements in the payment processing landscape.

Payment processing in the UK is an essential aspect of modern commerce, offering convenience and security to both businesses and consumers. With the diverse range of payment methods available, it’s crucial for businesses to stay up-to-date with these technologies to meet customer expectations and enhance their payment experience.

Understanding Payment Processing in the UK

Grasping the fundamentals of payment processing is crucial before delving into its individual components. Let’s first outline the overarching steps involved in payment processing in the UK, and then examine each element in more detail.

The process begins when a customer uses their card at a retail location or online. The card information, including the cardholder’s name and account number, is transmitted through a payment gateway. This gateway then forwards the details to the merchant’s bank. The payment processor, at this stage, alerts the card’s issuing bank about the transaction.

Upon receiving the transaction alert, the cardholder’s bank checks whether the account holds enough funds for the purchase. The transaction is subsequently approved or declined based on this verification. This phase is also crucial for detecting potential fraud (a topic we’ll explore more thoroughly later). This streamlined process underscores the importance of security and efficiency in UK-based payment processing.

Once the payment obtains approval, the issuing bank communicates the confirmation back to the retailer via the payment processor. This ensures that the transaction is duly recorded, and all relevant parties, including the merchant and the consumer, are informed through the payment gateway.

Although this process may initially seem intricate, we will delve deeper into the roles of gateways and processors shortly. It’s essential to remember that gateways primarily facilitate data transmission, while processors manage the actual transactional proceedings that culminate in a successful purchase. This breakdown is vital in understanding the intricacies of Payment Processing in the UK.

Understanding Payment Gateways in the UK

Payment gateways are fundamental to the entire payment processing system. A payment gateway acts as an intermediary service that facilitates communication among all parties involved in a transaction. This service is crucial both at the beginning and the conclusion of a card transaction in the UK.

Essentially, a payment gateway enables the banks of both the merchant and the consumer to interact for the execution of a transaction. Specifically, payment gateways in the UK:

- Establish secure connections for transmitting data between parties, employing encryption for heightened security.

- Transmit card data to the payment processor to facilitate the fund transfer.

- Notify both the merchant and consumer upon the completion of the payment.

In the UK market, most point-of-sale (POS) systems and card terminals incorporate payment gateways into their infrastructure, simplifying the components a business needs to handle. Moreover, various payment processors offer integrated gateway solutions, enhancing the efficiency of transaction processing.

Payment Processing: Understanding Payment Processors in the UK

In the realm of Payment Processing, if gateways serve as the communicative link between banks, then processors are the entities managing the actual logistics of those communications. A payment processor is a system that facilitates transactions between merchants and consumer banks in the UK. As suggested by its name, it handles the processing of credit and debit card payments, acting on the requests relayed through the gateway.

Payment processors in the UK are tasked with authenticating the information transmitted, ensuring its validity among all the banks involved. The processor is accountable for the actual movement of funds, if approved, from the issuing bank (the consumer) to the merchant account (the retailer).

As intermediaries for banks, merchants, and consumers, payment processors are available in various forms, each designed to cater to different transaction fulfillment needs. They operate as independent businesses, employing diverse models to levy charges for their services. These models include:

- Subscription-Based: These processors charge monthly or yearly fees and may also impose per-transaction charges. Examples in the UK market might include services similar to Stax and FreshBooks.

-

- Flat Rate: This model involves fixed fees per transaction. Though simpler, these costs can be higher than other options. UK counterparts to services like PayPal and Square are examples of flat-rate processors.

Understanding these different types of payment processors is crucial for UK businesses in selecting the most suitable Payment Processing solution to meet their specific needs and transactional dynamics.

Payment Processing Explained:

Payment processing encompasses the various steps involved when a business initiates a digital payment transaction. This complex process includes the initial card processing, establishing secure communication channels (gateways), and facilitating dialogue between the issuing banks and the consumer’s accounts. It’s a comprehensive series of actions ensuring that every digital transaction is executed smoothly, securely, and efficiently.

Merchant Accounts in UK Payment Processing

A vital element in the UK payment processing landscape is the merchant account. Distinct from regular bank accounts, merchant accounts are specifically designed for processing credit and debit card transactions. They serve as temporary repositories for funds during the settlement of pending transactions.

After a card payment is processed and the funds are authorized, the money is first transferred to the merchant account. This account holds and processes the funds, typically for a period of 24–72 hours, before they are transferred to the business’s bank account for use.

In addition to being fundamental in payment processing, merchant accounts in the UK offer businesses the flexibility to manage recurring payments and subscriptions, which often require the funds to be held and reprocessed. This makes them an indispensable tool for modern businesses navigating the digital transaction environment.

Security Practices in UK Payment Processing

In UK payment processing, security is paramount at every stage. Systems typically incorporate encrypted gateways to safeguard data, which is crucial because data breaches can be costly, damaging both finances and reputation. Key security measures include:

- EMV Chip Card Compatibility: Ensure your point-of-sale system is compatible with EMV chip cards, a standard developed by Europay, Mastercard, and Visa. These chips, embedded in most modern credit and debit cards, are designed to combat fraud, readable only by specialized devices.

- Adherence to PCI-DSS: Familiarize your business with the Payment Card Industry Data Security Standard (PCI-DSS). Compliance with these standards is often mandatory for merchants processing credit and debit card payments in the UK. PCI-DSS provides guidelines on what data should be retained (or not) during and after transactions, ensuring a baseline of security and data protection.

Getting Ready for Payment Processing

The payment processing system is tailored to simplify and expand the ways in which merchants receive payments from consumers, offering a secure and streamlined method for handling digital transactions. A fundamental understanding of this process equips business owners to accept payments securely and proficiently. By prioritizing security, merchants not only ensure safe transactions but also broaden the payment options available to their customers.

Take the Next Step

Ready to streamline your payment processing? Fill out our quick, no-obligation form to discover the best payment processing solution for your business. Or, if you prefer a more direct approach, book a quick phone call with us. In just a few minutes, we can guide you through the entire setup process, ensuring you’re equipped with the perfect solution tailored to your business needs. Let’s make your payment processing journey smooth and secure.